Energy tech firm – Open Energy Market – has closed a £3million investment round from Calculus Capital to help further develop its online trading platform for the management of energy contracts.

The platform was built to streamline the complicated and antiquated procurement process and to assist medium-large enterprises with the management of their energy contracts.

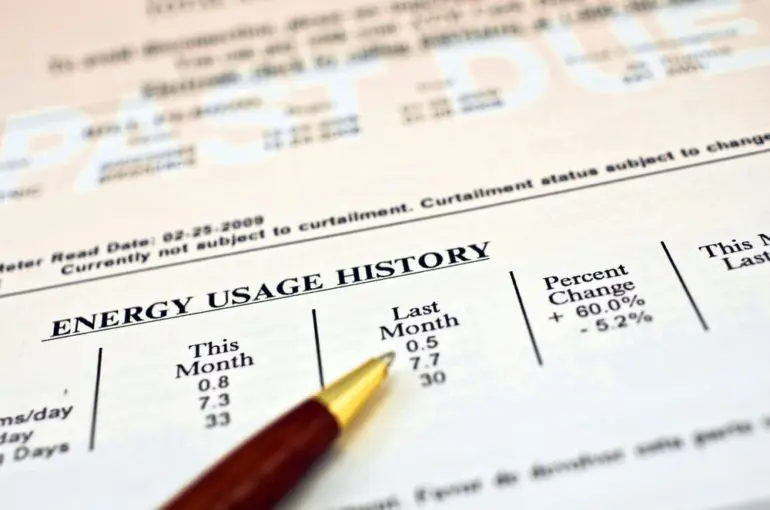

The corporate energy market contracts total £20 billion per year, of which 85% are bought using an energy broker, according to Ofgem. However, this market has traditionally suffered from inefficiency and complexity, along with a lack of transparency, that has made the energy procurement process a painful and laborious one for customers.

For business customers with larger scale energy requirements, picking the right buying strategy and shopping for the best deals is typically a confusing and labour intensive process. Lack of transparency can also be a problem when it comes to differentiating the best deals on the market.

The Open Energy Market platform brings a level of automation to energy trading, not only transparently engaging and illustrating competition between suppliers, but also capturing and storing the data that makes reporting, forecasting and portfolio management easier.

The platform has already benefited over 200 businesses, such as Dairy Crest, EasyJet, Southampton FC and London Business School, as well as a host of large councils, hospitals and schools.

Open Energy Market was launched in 2013 by Chris Maclean and Charles Lass. Chris is an energy industry expert who had first-hand experience of the inefficiencies associated with the energy brokering market and Charles is a tech entrepreneur with a history of founding and growing tech businesses such as ControlPoint and ViaPost.

The company works with all major providers and will use the injection of funds to increase their team and to implement significant platform developments, including extensions into other commodities and expansion into the US market.

Founder and Chief Executive of Open Energy Market, Chris Maclean said: “The market was crying out for innovation that could help large businesses better manage the confusing, convoluted and inefficient processes associated with energy procurement. In an age where technology has helped streamline most business operations, it still amazes us how antiquated and manual our industry is.

Our platform uses technical automation to cut through the complex market processes, alleviating many of the pain points that energy buyers face and ensuring their route to market is as efficient and as informative as possible.

This is an exciting time for OEM as this partnership with Calculus will enable us to push our platform out to a wider audience and implement further innovative tools that will continue to re-shape the industry.”

Alexandra Lindsay, Investment Director of Calculus Capital, said: “What the team at Open Energy Market have done is to streamline the broker process, because all the major suppliers are there on a single platform bidding for a company’s business.

“The service is designed to give companies greater transparency of their annual utility costs before they sign a contract.

“Our investment will help them strengthen their sales and software teams, expand their platform to cover additional utility services and make a move into the US market.

“We believe this is an exciting phase in the development of a company with strong growth potential.”