According to recent research from Standard Life, over half of young British employees are keen to learn more about the Government’s new auto-enrolment initiative.

Category: Finance

Financial advice for owners and managers of small and medium sized business SMEs in the UK All your tax, borrowing and administration advice

Three quarters of UK businesses unimpressed with government funding initiatives

Recent statistics show that nearly 80 per cent of UK firms feel that recent government funding initiatives such as Funding for Lending and Project Merlin have not helped their businesses.

Top ten tips on raising finance for SMEs

Daren Bekisz, partner at Begbies Traynor in Yorkshire, offers advice for SMEs on obtaining funding

British businesses missing out on millions of pounds in R&D grants

Many British businesses are failing to claim the money that they are entitled to, according to an expert in Research and Development (R&D). Richard Cullum, Managing Partner of tax specialists R&T Consultants, believes that numerous companies across the region are missing out the tax relief available to both SMEs and larger companies because they are unfamiliar with the latest tax and grant incentives.

Give London small businesses a tax break during London 2012

News that big broadcasters and their employees and contractors will be exempt from UK tax during London 2012, has prompted calls for small businesses in the Capital to get a tax break too.

Terms of Endearment: Avoiding Late Payment Penalties

Whether late payments happen by accident or design, they may soon be attracting penalties for businesses. Lucy Beck, UK sales director for Palette why organisations should get control of their accounts payable and build better relationships with suppliers.

If you ask nicely you might get paid quicker

New research reveals that old fashioned good manners will speed up the payment of bills and invoices, with 45 per cent of companies admitting they will speed up payment if they are asked nicely.

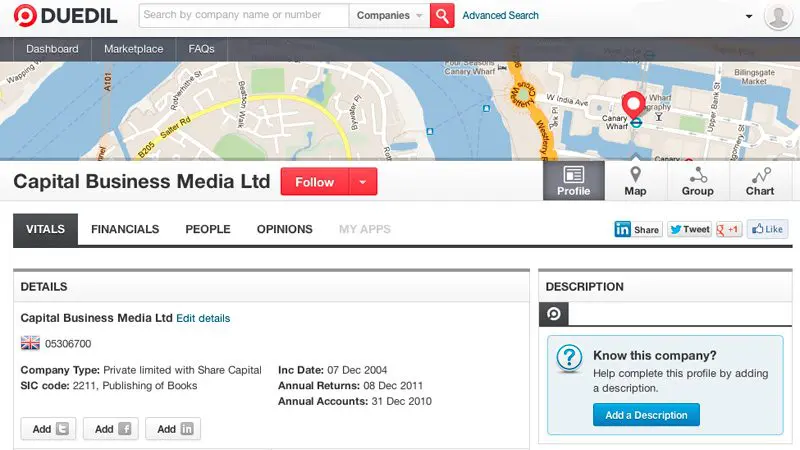

Duedil launches features that are part of on-going redesign

Duedil, the world’s largest database of free company financials, is rebuilding their website to improve users’ access to data from all over the web. A string of features launched recently include a Google Chrome extension, new financial ratios widget and faster data imports.

Santander announces new Internship programme for small business

Santander UK Chief Executive Ana Botín has extended the bank’s support for SMEs, building on a 25 per cent increase in lending over the past two years, with the launch of a new programme to place graduates from the country’s top universities on internships with SMEs across the UK.

Business owners patience runs out as the week progresses over bad debts

If you are a late payer on a mission to avoid your creditors, the best days to be in the office are Mondays and Tuesday – the worst – Thursdays and Fridays.

ABN AMRO agrees £19M finance package with James Caan’s Hamilton Bradshaw

Hamilton Bradshaw, one of the world’s top 50 recruitment companies, has secured a £19m global facility from Invoice and Asset Based lender, ABN AMRO Commercial Finance for its staffing sector investment fund, Human Capital Investment Group.

Over one million SMEs unaware of energy savings on offer with cloud computing

Nearly 90 per cent of UK SMEs surveyed said that they were unaware they could make significant savings on their IT energy footprint by moving their business into the cloud, according to new research by energy company, E.ON

A poor reputation and expensive: UK SMEs reject payday loans

Expensive, with high interest rates and a poor reputation; the latest independent research from BDRC Continental shows the UK’s SMEs do not appear to welcome payday loans as a means of financing their business.

James Caan to chair new Board to distribute £82.5m of start-up business loans to young entrepreneurs

Former BBC Dragon’s Den star James Caan has been approached by Lord Young, advisor to David Cameron on Enterprise, to help the Government drive an initiative to provide start up loans to young people across the country.

Beware of bad debt

SMEs are urge to measure the financial strength of other companies before doing business with them.